Digital lending has emerged as a game-changer, reshaping the borrowing experience with unprecedented speed, convenience, and accessibility. Gone are the days of endless paperwork and prolonged waiting times—now, individuals can secure loans within minutes from the comfort of their homes. However, as financial transactions shift to digital platforms, the importance of adhering to compliance standards has never been more crucial. Compliance serves as the foundation for ethical, transparent, and secure digital lending, safeguarding user data and ensuring that financial institutions operate within the bounds of law and integrity. In this blog, we’ll explore what is digital lending application audit, benefits for compliance in digital lending, rooted in the latest industry trends.

Table of Contents

What is Digital Lending Application Audit?

The Reserve Bank of India (RBI) issued guidelines for digital lending, establishing a regulatory framework for lending activities carried out by FinTech companies and Digital Lending Applications (DLAs). These Digital Lending Guidelines, developed based on the recommendations of the Working Group on ‘Digital Lending including Lending through Online Platforms and Mobile Apps’ (WGDL), address issues like third-party overreach, data privacy breaches, unfair practices, excessive interest rates, and unethical debt recovery methods.

The framework covers RBI-regulated entities (REs), Lending Service Providers (LSPs) engaged by REs for credit facilitation, as well as DLAs operated by both REs and LSPs. Additionally, due to technical complexities, certain recommendations will undergo broader discussions with the government and stakeholders.

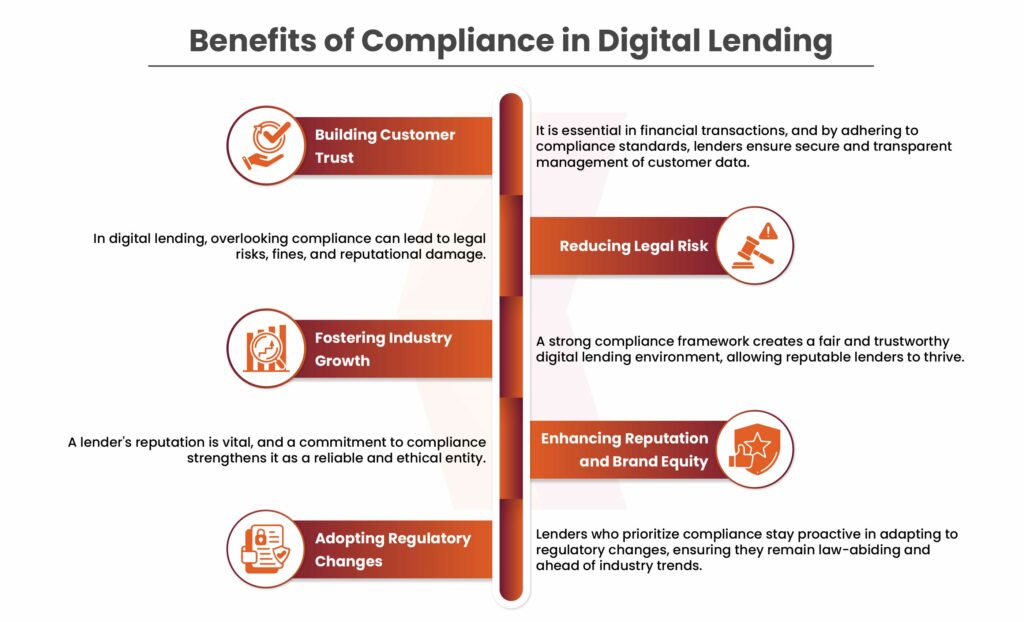

Benefits of Compliance in Digital Lending

More than just a regulatory requirement, strong compliance offers numerous benefits that protect both borrowers and lenders while driving progress in the digital lending industry. Here’s a look at the powerful advantages of maintaining robust compliance in this dynamic field:

Building Customer Trust

Trust is the backbone of any successful financial transaction. In an age of data breaches and privacy concerns, a strong commitment to compliance shows customers that their interests are a priority, building trust that drives repeat business and positive referrals.

Reducing Legal Risk

In the dynamic world of digital lending, neglecting compliance can quickly lead to significant legal risks. Failure to meet regulatory standards may result in hefty fines, reputational damage, and even legal action. By strictly adhering to laws on data privacy, consumer protection, and fair lending practices, lenders protect themselves from potential legal challenges, safeguarding both their financial stability and industry reputation.

Fostering Industry Growth

Strong compliance creates a fair environment where reputable lenders can shine, attracting borrowers who value platforms that prioritize their interests. As the industry builds a reputation for responsible practices, it draws increased interest from investors, regulators, and potential partners, fueling growth and innovation.

Enhancing Reputation and Brand Equity

A lender’s reputation is its greatest asset. Commitment to compliance strengthens a lender’s standing as a trustworthy and ethical industry participant. This leads to positive word-of-mouth, favorable media attention, and increased customer satisfaction, all of which enhance brand value. Borrowers are more inclined to choose lenders with a strong compliance record, driving long-term success.

Adopting Regulatory Changes

The financial regulatory environment is ever-evolving. Lenders who prioritize compliance foster a proactive stance on monitoring and adjusting to regulatory changes. This adaptability keeps them compliant while positioning them as industry leaders who stay ahead of trends and anticipate potential challenges.

Recommendations Approved for Implementation

The recommendations approved for immediate implementation primarily focus on consumer protection, data privacy, and establishing a regulatory framework.

Consumer Protection

According to the Digital Lending Guidelines, loan disbursements and repayments must be made directly between borrowers and the bank accounts of the regulated entities (REs), and cannot be routed through third-party pass-through accounts. Digital Lending Applications (DLAs) are required to calculate the Annual Percentage Rate (APR) for loans using built-in algorithms that account for the total cost and margin. REs must ensure digitally signed transaction documents are auto-sent to borrowers’ registered email or SMS after loan execution.

The method for filing complaints should be available on the DLA and its website. If a complaint is not resolved by the RE within 30 days, borrowers may escalate the issue through the Complaint Management System or another mode under the Reserve Bank-Integrated Ombudsman Scheme.

REs are authorized to capture the economic profile of borrowers to assess their creditworthiness in a verifiable manner.

Technology and Data Requirements

According to the Digital Lending Guidelines, DLAs must collect data on a need-to-know basis and with prior consent from the borrower. Biometric data related to customer due diligence cannot be stored in the systems of DLAs. Additionally, DLAs are prohibited from accessing files, media, contact lists, call logs, and similar data stored on borrowers’ phones. However, with consent, DLAs may request one-time access to the camera, microphone, location, or other features necessary for onboarding or KYC purposes.

Any data collected must be stored within India. DLAs are also required to make their privacy policy publicly available, which should include details about any third parties allowed to collect personal information through the platform and the purpose of such data collection.

Get in!

Join our weekly newsletter and stay updated

Kratikal’s Approach to Digital Lending Application Audit

Kratikal follows a comprehensive approach to ensure the security and compliance of Digital Lending Applications through a thorough audit process. Here’s how we approach the Digital Lending Application audit:

Business Understanding

We begin by gaining a comprehensive understanding of the client’s business model, objectives, and regulatory environment. This ensures our audit is tailored to the specific needs and risks associated with the digital lending platform.

Application Walkthrough

Our team conducts a detailed walkthrough of the digital lending application to identify critical functionalities, workflows, and integration points. This step helps in mapping out the audit scope accurately.

Preparation of Requirement Sheet

We compile a detailed requirement sheet that outlines the specific data, documentation, and access needed for the audit. This ensures that all necessary information is gathered systematically.

Evidence Collection

The security team at Kratikal gathers all the relevant evidence, including logs, configurations, policies, and user data. This step involves collaboration with the client’s technical and compliance teams to ensure completeness.

Evidence Validation

Our auditors meticulously validate the collected evidence against industry standards and regulatory requirements. This step helps identify any discrepancies or non-compliance issues.

Reporting

We prepare a comprehensive audit report that details findings, risk assessments, and recommendations for remediation. This report is designed to help the client enhance their digital lending application’s security and compliance posture.

Book Your Free Cybersecurity Consultation Today!

Conclusion

Digital lending offers numerous benefits, but it also brings challenges that can be effectively addressed through strong compliance practices. By adhering to regulatory guidelines, Digital Lending Application (DLAs) can build trust with borrowers, reduce legal risks, enhance their reputation, and contribute to the overall growth of the industry. Compliance ensures that digital lending remains secure, transparent, and fair, protecting both consumers and lenders. As the financial regulatory environment continues to change, staying ahead of these shifts will position lenders as leaders in the market, fostering innovation and driving responsible lending practices for the future.

FAQs

- What is DLG in digital lending?

A Digital Lending Guarantee (DLG) is a contractual agreement between a bank and an entity, where the entity agrees to compensate the bank for losses resulting from defaults, up to a specified percentage of the bank’s loan portfolio. - 2.What is the role of fintech in digital lending?

- Fintech lenders collect vast amounts of data from customer interactions on their digital platforms. This data offers valuable insights into customer behavior, market trends, and the performance of financial products, enabling lenders to spot growth opportunities and make informed strategic decisions.

Leave a comment

Your email address will not be published. Required fields are marked *