Cyberattacks are growing. Also, research confirms that attacks like ransomware occur every two seconds. In the literal sense, as we read this line, an organization becomes a victim of a cyberattack. Hackers have now drifted their focus from healthcare and financial industry to the insurance sector in the later months of 2024. Cyber risk can be seen looming more extensively among insurance companies in India, casting a heavier shadow on their operations. Insurance companies hold a lot of data, which is a jackpot for malicious actors. Among the many valuable data, what drives the threat actors the most are the extensive amount of monetary records, customers’ financial information, medical records, as well as the information held by the policyholders.

Table of Contents

Cyber Risk Linked to the Insurance Industry

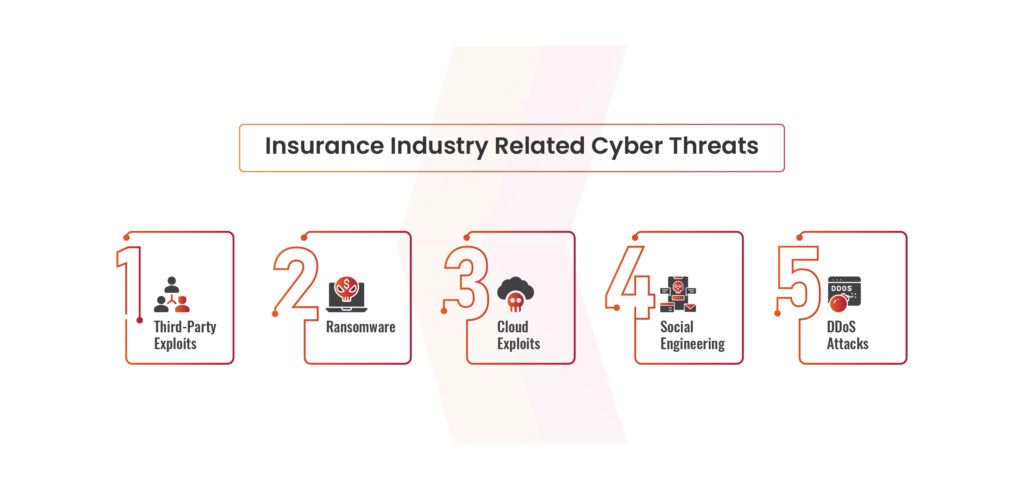

Some of the common cyber threats seen in the insurance industries are as follows:

Third-Party Exploits

It is common for insurance companies to work with third-party vendors. Some of the common services where they take help from third-party vendors include IT management, data processing, and customer support. Thus, it is understood that the third-party vendors may have access to company networks or sensitive data. Insurance companies are more prone to cyber risk if their vendor’s security is weak.

Ransomware

Insurance companies are highly prone to ransomware attacks. Ransomware is a type of attack where threat actors put malicious software in the company assets to encrypt the data and lock it. They then start demanding ransom to unlock the access. Ransomware attacks can lead to loss of data, disruption in operations, and financial loss. In cases where the company doesn’t pay, the data might be permanently lost or sold to other threat actors.

Cloud Exploits

Cloud storage is important for insurance companies to store data. Some of the benefits include cost-efficiency and easy access. Data stored in clouds include social security numbers, medical details, and addresses. Hackers can exploit these loopholes to steal information and disrupt operations if the cloud system is not properly secured. Cloud-related cyber risk surfaces when an insurance company’s password is weak, and security settings are not updated on a regular basis, among many others.

Social Engineering

Through social engineering, a threat actor can impersonate an insurance agent in an email, or phone call and ask the targeted customer to click on malicious links or provide personal information. In case the customer falls victim, the hackers use the information to steal money or commit other serious frauds. Through this attack method, hackers also try to retrieve login credentials or insurance details.

DDoS Attacks

Insurance companies receive a lot of requests from customers during natural disasters or similar situations where a large number of people fall victim to some mishaps. During these busy times, threat actors attempt to launch Distributed Denial of Service (DDoS) attacks on these insurance companies. It floods the website with a large number of unusual traffic causing the system to crash. The impact of this attack is that it can disrupt online services and prevent customers from logging into their accounts and filing claims.

Real-Time Data Breaches in India

The insurance industry in India has witnessed some serious breaches throughout the year. The frequency of such attacks increased in the later phase of the year. Starting with the Aadhar Data Breach in January where 750 million individuals’ personal data was compromised, followed by another big data theft in an insurance company in July 2024. Personal information including bank account numbers of around 7.9 million customers was leaked. In the last quarter of 2024, multiple insurance companies fell victim. The numbers were big. Among the stolen data were names, phone numbers, addresses, tax details, and medical records of 31 million customers. xenZen, identified as the hacker in one such insurance company, used the Telegram platform to sell 7.24 TB of data. Later, the hacker attempted to sell 6 million claim records on a self-hosted website.

Book Your Free Cybersecurity Consultation Today!

Reasons Behind the Frequent Data Breach

- Industry Size:

The insurance industry size is said to be the 10th largest in the world. India’s insurance industry is expected to reach a market size of $216.7 billion by the end of 2024. The life insurance segment will be the largest, valued at $111.5 billion. The average spending per capita on insurance is estimated to be $150.30. Not only that, the health insurance premiums increased by 20.2% in 2023-24, exceeding Rs. 1 trillion. With each bigger number, the insurance sector has become a prime target for the threat actors.

- Increased Scope of Attack:

India has the second-largest market in insurance technology in the Asia Pacific region. The technological advancements adopted by the industry have made work seamless for the policyholders, however, it has also given threat actors new ways to play their part. The usage of AI-powered chatbots, Usage-Based Insurance (UBI) to determine insurance premiums using real-time data, and access to policies through mobile apps and online platforms to pay premiums or gather real-time data have given rise to multiple attack surfaces for the threat actors.

- Confidential Data:

Insurance companies hold a lot of sensitive data of their customers. It includes names, addresses, phone numbers, location details, financial information, assets, medical details and many such important details. Thus, for malicious actors entry into such organizations can lead to multiple data that they can use to exploit. Above all, the policyholders need to retain such sensitive information thus allowing insurers to customize products, policies, and prices for every client the insurer has further alleviating the cyber risk factor.

Preventive Cyber Security Tips for Insurance Companies

Here are some of the cybersecurity solutions that organizations can implement to prevent cyber threats:

Network Security

Organizations must regularly conduct VAPT Audit. They must make sure to protect their network infrastructure. Network Penetration Testing ensures that there is no unauthorized access, misuse, or vulnerabilities. Having a strong firewall acts as a barrier between an organization’s internal network and external threats while filtering out harmful data. Intrusion Detection Systems (IDS) prevent breaches in networks. A VPN encrypts internet traffic and ensures that users can securely access company resources remotely.

Access Control

Access Control is one of the highly effective security measures that organizations can implement. It ensures that only authorized users can access certain applications, data, assets, and networks. Moreover, it reduces the risk of internal and external threats. Implementing Role-Based Access Control (RBAC) ensures that users only access the resources necessary for their job functions. Multi-Factor Authentication (MFA) adds an extra layer of security. The Least Privilege Principle is also effective. It ensures that users have the minimum level of access needed to perform the tasks, thus, reducing the impact of a potential breach.

Encryption

Encryption can help prevent threat actors from getting unauthorized access. It is the process of converting data into codes that can be deciphered by those with the correct decryption key. It helps protect sensitive information. Data encryption at rest ensures that sensitive data, like customer information or financial records, is encrypted when stored on servers or databases.

Data encryption in transit encrypts data as it travels over the internet and protects it from being intercepted during communication. End-to-End Encryption (E2EE) ensures that data remains encrypted from the sender to the recipient, preventing third parties from accessing the data during transmission, thus, eliminating cyber risk in the process.

Continuous Monitoring

Insurance industries must constantly track and analyze the organization’s network and endpoints for potential security threats. By doing so, it helps detect suspicious activity allowing organizations to respond at the earliest possible. Continuous monitoring can help detect abnormal behavior, such as an employee accessing sensitive data at unusual times, indicating a potential insider threat.

Get in!

Join our weekly newsletter and stay updated

How Kratikal Can Help Manage Cyber Risk in Insurance Companies?

- Kratikal can help organizations assess the security levels of the organization. It can also help implement an incident response plan to manage cyber risks.

- Organizations need to conduct regular VAPT to ensure that their network and other assets are free from any loopholes.

- Through Kratikal’s VMDR Tool AutoSecT, which is an automated pentesting tool for web and mobile apps, cloud, and API, organizations can receive immediate cyber risk alerts when any vulnerability is detected, allowing security teams to take prompt action.

- Kratikal is a CERT-In Empanelled Auditor. It can ensure that your organization is compliant with the regulatory and standard requirements. Also, all insurance companies in India must compulsorily get their IRDAI compliance audit done.

FAQs

- What are the risks of cyber security for insurance companies?

Insurance companies are now at high risk of cyber threats. It can take many forms. But the most common attack methods used include ransomware attacks, Advanced Persistent Threats (APTs), DDoS Attacks, compliance and regulatory risks, third-party risks, phishing and social engineering attacks along with data breaches and theft.

- What is the biggest challenge facing the insurance industry?

Among the many challenges faced by the insurance industry, cybersecurity threats are listed amongst the top in the list. Furthermore, the sensitivity of data that the insurance companies hold makes it a prime target for the threat actors.

Leave a comment

Your email address will not be published. Required fields are marked *