The rise in android users has transformed how individuals and businesses access financial services, offering convenience and speed like never before. However, this rapid digitalization has also made these platforms a prime target for hackers. SpyLoan malware is a threat specifically engineered to exploit vulnerabilities in digital lending ecosystems. By stealing sensitive customer data, manipulating loan disbursements, and compromising operational systems, SpyLoan poses a growing risk to the integrity of online lending, demanding immediate and robust countermeasures.

Table of Contents

What is a Spy Loan Malware?

SpyLoan is a malicious malware embedded within deceptive loan applications specifically targeting Android users. These apps are designed to appear as legitimate financial tools, leveraging social engineering techniques to gain users’ trust and convince them to grant extensive access permissions. Once installed, SpyLoan covertly harvests a wealth of sensitive information, including:

- Contacts, Messages, and Call Logs: Enabling attackers to profile victims, exploit their personal connections, and initiate further phishing or harassment campaigns.

- Location and Device Details: Hackers can track the victim’s whereabouts and analyze device vulnerabilities for further exploitation.

- Personal Financial Data: Accessing critical information like bank account details, transaction histories, and passwords, puts victims at significant financial risk.

SpyLoan malware preys on unsuspecting users demonstrating the increase in cyber threats. What’s particularly concerning is that these apps managed to bypass Google Play Store’s stringent security filters and were made available to users on the platform.

The Growing Threat of SpyLoan Malware on Android Devices

Android users face an alarming rise in malicious apps, with over a dozen loan applications—collectively known as SpyLoan—posing significant threats. Downloaded more than 8 million times from the Google Play Store alone this year, the real count is likely higher due to their availability on third-party stores and dubious websites. SpyLoan malware secretly takes sensitive data from infected Android devices, including account lists, device details, call logs, calendar events, and installed apps. It can also access contacts, location data, and text messages, endangering user privacy.

Masquerading as legitimate personal loan services, these apps lure users with promises of quick loans. Victims end up trapped by exorbitant interest rates, with some facing threats and blackmail if unable to pay. Cybersecurity experts, including ESET—an App Defense Alliance member—have flagged 18 such apps since the start of 2024. While Google has removed 17 of these from its Play Store, one app reappeared, modified to evade detection.

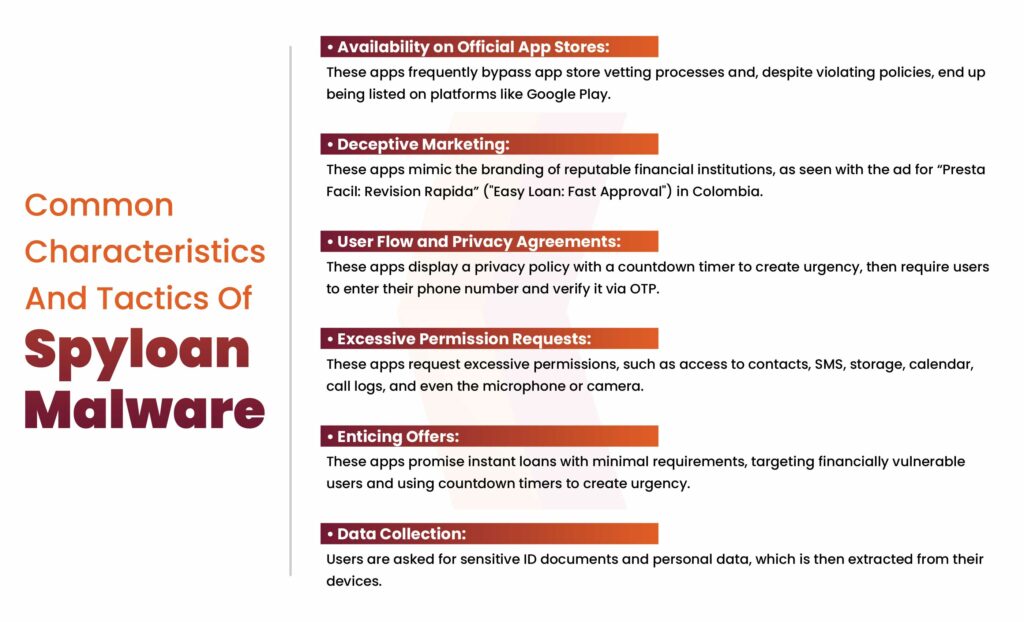

Common Characteristics and Tactics

SpyLoan apps share several distinctive characteristics:

Availability on Official App Stores: These apps often manage to bypass app store vetting processes, despite violating policies, and are listed on platforms like Google Play.

Deceptive Marketing: These apps imitate the names, logos, and user interfaces of reputable financial institutions to appear credible. For example, an advertisement for “Presta Facil: Revision Rapida” (translated as “Easy Loan: Fast Approval”) was observed in Colombia.

User Flow and Privacy Agreements: When launched, these apps present users with a privacy policy and a countdown timer designed to create a sense of urgency. They then prompt users to enter their phone number, including the country code, and verify it using a one-time password (OTP) sent via SMS.

Excessive Permission Requests: These apps demand unnecessary permissions, including access to contacts, SMS, storage, calendar, call logs, and even the microphone or camera.

Enticing Offers: These apps lure users with promises of instant loans and minimal requirements, specifically targeting those in urgent financial need. They often use countdown timers to amplify the sense of urgency.

Data Collection: Users are prompted to submit sensitive identification documents and personal information, which is subsequently extracted from their devices.

Global Impact of SpyLoan Apps

SpyLoan apps have been reported worldwide, with adaptations tailored to different regions. In India, users have experienced harassment from apps that exploit permissions, while Southeast Asian countries like Thailand and Indonesia have encountered significant problems. In Africa, nations such as Nigeria and Kenya have seen financial fraud targeting unbanked populations, and in Latin America, users in Mexico, Colombia, Chile, and Peru have reported threats and harassment linked to these apps.

Authorities have begun taking steps to combat these fraudulent activities. In Peru, a major raid on a call center involved in extortion uncovered a scam affecting at least 7,000 victims across multiple countries. Similarly, in Chile, over 25 individuals were arrested in connection with a fake loan operation that defrauded more than 2,000 victims. Despite these efforts, the global prevalence of these malicious apps continues to grow.

How Can Organizations Protect Themselves from Such Malware?

Conduct Regular Vulnerability Assessment and Penetration Testing (VAPT)

Organizations should routinely perform VAPT to identify and fix vulnerabilities in their systems, networks, and devices. This process simulates real-world attack scenarios to uncover security gaps that malicious actors, including malware like SpyLoan, could exploit. Regular mobile application testing ensures that weaknesses are addressed promptly, reducing the likelihood of successful cyberattacks.

Restrict App Sources and Validate Applications

To minimize risks, organizations must enforce policies allowing app installations only from trusted sources, such as the Google Play Store. Even then, security teams should check apps before deployment. This includes verifying app reviews, checking for suspicious developer credentials, and ensuring the permissions requested are justified for the app’s purpose.

Deploy Mobile Device Management (MDM) Solutions

MDM tools allow organizations to maintain control over mobile devices used within their infrastructure. These tools can enforce app whitelisting, restrict access to unauthorized apps, and monitor device activity for signs of compromise. With MDM, organizations can ensure that every Android device adheres to security policies, mitigating the risk of malware infections.

Implement Least-Privilege App Permissions

Organizations should promote the principle of least privilege when granting app permissions on Android devices. Restricting apps to only the permissions they genuinely require minimizes the amount of data accessible if a malicious app gains a foothold, thereby reducing the overall impact of a breach.

Conclusion

SpyLoan malware highlights the growing risks in the digital lending ecosystem, exploiting users’ trust and their urgent need for financial assistance. By disguising themselves as legitimate apps and bypassing security measures, these malicious applications have created a global impact, targeting unsuspecting users across various regions. While efforts by authorities and cybersecurity organizations have mitigated some threats, the prevalence of SpyLoan apps continues to rise.

To protect yourself, it’s essential to remain vigilant, review app permissions, verify legitimacy, and adopt strong cybersecurity practices. Awareness and proactive action are the keys to safeguarding your personal and financial information in today’s increasingly digital world.

FAQs

- How can I identify a SpyLoan app? Look for red flags such as:

Poor or fake app reviews on the Google Play Store.

Unusually high permission requests, like access to contacts or location, without a clear reason.

Developers with suspicious or unverifiable credentials.

Unclear terms of service or hidden fees. - 2.What actions are being taken to address SpyLoan malware?

- Companies like ESET and Google’s App Defense Alliance actively work to identify and remove such apps from the Google Play Store. However, modified versions often resurface, so users must remain vigilant.

- 3.What is SpyLoan malware?SpyLoan is a type of malware embedded within deceptive loan applications, primarily targeting Android users. These apps pose as legitimate financial services but exploit user permissions to collect sensitive data and engage in fraudulent activities such as blackmail or extortion.

- 4.Are SpyLoan apps available only on third-party stores?No. While many are found on third-party app stores and suspicious websites, some SpyLoan apps have bypassed Google Play Store’s security filters and been made available there.

- 5.How do SpyLoan apps operate?SpyLoan apps use social engineering tactics to gain users’ trust and permission to access the app. They harvest sensitive information such as contacts, messages, call logs, device location, financial details, and even metadata from images. This data is then exploited for financial fraud or blackmail.

Leave a comment

Your email address will not be published. Required fields are marked *