In today’s digital age, businesses place high importance on safeguarding sensitive data and making sure credit card transactions are secure. The Payment Card Industry Data Security Standard (PCI DSS) fills this role. All businesses that accept, process, store, or transmit credit card information must adhere to the PCI DSS security guidelines to maintain a secure environment.

Nevertheless, navigating PCI DSS compliance can be a difficult procedure. To assist organizations in comprehending PCI DSS rules, implementing best practices, and remaining compliant with the most recent modifications and upgrades, we established this blog. Our blog will give you the knowledge and tools you need to ensure the security of the information about your customers, whether you are new to PCI DSS or are already familiar with it.

Table of Content

What is PCI DSS?

The Payment Card Industry Security Standards Council is in charge of overseeing PCI DSS, which is centered on supporting networks, systems, and other payment card processing machinery. All businesses that receive, store, or transmit credit card information must comply with the Payment Card Industry Data Security Standard (PCI DSS), which is a set of guidelines.

No matter the size or volume of transactions, PCI DSS compliance is required of all businesses that process or accept payment cards with any of the five main credit card brands as their logos (Visa, MasterCard, American Express, Discover, etc). Policies, security management, processes, software design, network architecture, and other essential protective measures are all covered under PCI DSS regulations. To protect sensitive credit card information and lower the risk of data breaches, businesses must adhere to PCI compliance.

“More than 10.9 billion records with sensitive information have been breached according to public disclosures between Jan 2005 and July 2018, according to research.”

Applicability of PCI standards

Everyone that accepts credit/debit cards for any good or intangible offering globally is subject to PCI processing standards and audits, including:

- Online Services

- Services in Retail stores

- Financial services companies that carry PCI processing

- Credit/Debit Issuing Bank, credit union, or institution

Steps for adhering to the PCI DSS

There are 3 ongoing steps for adhering to the PCI DSS:

- Access –The location of all cardholder data must be determined. One should also make a list of your IT resources and business procedures for accepting credit and debit cards and examine them for any potential security loopholes.

- Repair – This approach aids in addressing vulnerabilities that have been discovered, safely erasing any unneeded cardholder data storage, and putting in place secure business procedures.

- Report – The last phase entails recording evaluation and remediation information and submitting compliance reports to the acquiring bank and card brands with which the business is being conducted.

Tools available for PCI Data Security Standards(PCI DSS)

All organizations that retain, handle, and transfer cardholder data are subject to the PCI DSS. It encompasses the parts of the system that are technical or functional. PCI DSS will be relevant if you process or accept payment cards.

- Self-Assessment Questionnaire – A validation tool for qualified businesses who evaluate their compliance with PCI-DSS on their own and are not required to submit a Report on Compliance (ROC).

- PIN Transaction Security(PTS) requirements – a collection of security requirements focusing on the design and operation of equipment used to safeguard cardholder PINs and conduct other payment-processing-related operations.

- Payment Application Data Security Standard( PA-DSS) – It refers to software developers, among others, who create programs that receive, process, or store cardholder data. Almost all card issuers encourage businesses to adopt PCI SSC-tested and authorized payment solutions.

- PCI Point-to-Point Encryption Standard(P2PE) – It offers a thorough set of security standards for P2PE solution providers to evaluate their P2PE solutions and enable merchants utilizing such solutions to adhere to less PCI DSS.

- Qualified Assessors – The council has given the qualified security assessors (QSA) and approved scanning vendors (ASV) permission to evaluate compliance with the PCI DSS and confirm adherence to the standard. Internal Security Assessors can receive PCI DSS training from the council (ISAs).

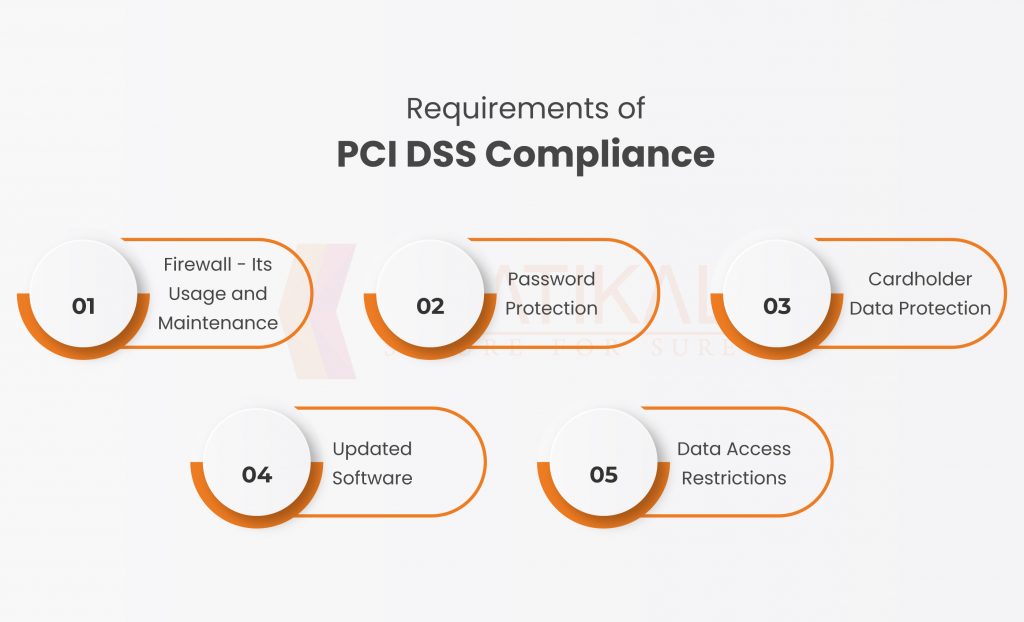

Requirements of PCI DSS Compliance

- Firewall – Its Usage and Maintenance – Essentially, firewalls prevent unauthorized or foreign groups from accessing sensitive data. These preventative measures are frequently the first line of defense against cybercriminals (malicious or otherwise). The efficiency of firewalls in preventing unauthorized access makes them necessary for PCI DSS compliance.

- Password Protection- Routers, modems, POS systems, and other third-party goods frequently have generic passwords and security features that are accessible to the general public. Businesses fall short much too frequently of closing these gaps. Maintaining a list of every piece of hardware and software that demands a password is one way to ensure compliance in this area.

- Cardholder Data Protection – A specific set of algorithms must be used to encrypt card data. Encryption keys, which must likewise be encrypted for compliance, are used to implement these encryptions.

- Updated Software – Updates are frequently needed for firewall and antivirus software. Every piece of software in a company should be updated as well. The majority of software programs will incorporate security measures, including patches to fix recently found vulnerabilities, in their updates, adding an additional layer of security.

- Data Access Restrictions – Cardholder data must only be accessible by those with a genuine need to know. The data should not be accessible to any employees, executives, or other parties. The PCI DSS mandates that the responsibilities that do require sensitive data be well-documented and updated on a regular basis.

Benefits Associated with PCI DSS Compliance

- Enhanced Security: Compliance with PCI DSS helps ensure the protection of sensitive customer information, such as credit card numbers and personal data.

- Improved Customer Trust: Demonstrating PCI DSS compliance can instill confidence in customers that their information is secure when they do business with you.

- Increased Market Opportunities: Some companies require that their vendors and partners comply with PCI DSS, so compliance can open up new business opportunities.

- Protection from Data Breaches: PCI DSS requires implementing strong security measures, which reduces the risk of data breaches and their associated costs and reputational damage.

- Compliance with Legal Requirements: In some jurisdictions, compliance with PCI DSS may be a legal requirement for businesses that handle sensitive payment information.

Boosting your knowledge of PCI DSS WIth Kratikal

Kratikal’s CERT-IN Empanelled organization and tools are available to help you straight away with comprehending the changes, assessing their impact on the security objectives of your business, offering implementation guidance, and moving your certification. In addition to our VAPT services, we provide security auditing for Compliance, including SOC2, ISO/IEC 27001, GDPR, HIPAA, and others.

Kratikal’s adherence to the Payment Card Industry Data Security Standard (PCI DSS) is an important factor in ensuring the security and protection of sensitive payment card information. By following the strict guidelines and requirements set forth by the PCI DSS, Kratikal is able to provide a secure environment for processing, storing, and transmitting cardholder data, thus reducing the risk of data breaches and ensuring customer confidence in the safety and security of their payment information.

Overall, Kratikal’s compliance with the PCI DSS demonstrates its commitment to providing the highest level of security for its customers. The fact that Kratikal adheres to PCI DSS compliance shows its dedication to protecting the security and privacy of sensitive consumer data. Customers can be confident that their personal and financial information is secure.

Contact us by leaving a comment below if you have any questions concerning our PCI DSS compliance or any other compliance.