RBI has issued comprehensive master directions and guidelines for banks and non-banking financial corporations to identify and address operational risks and weaknesses. These guidelines are based on recommendations from working groups focused on information security, e-banking, governance, and cyber fraud. The primary motivation behind these directives is the growing need to mitigate cyber threats arising from the advanced technologies adopted by these institutions. In this blog, we will discuss IS audit, its advantages, and why organizations need to perform the RBI audit.

Table of Contents

What is IS Audit?

IS Audit or RBI compliance audit serves as a critical element for banks, ensuring robust IT security and governance. These standards require regular IT audits using customized applications, skilled resources, and verified procedures to streamline the process. Our organization comprises experienced professionals adept in Application Control, Security Services, and Internal Information System Audits, providing thorough evaluations of IT infrastructure. As per the directive, a CERT-IN empanelled institution must perform an Information Security Audit annually. Data security, audit control, corporate governance, risk management, and license terms are key aspects of the RBI Audit.

Advantages of IS Audit

The advantages of RBI compliance audit are listed below:

Identification of Vulnerabilities

RBI cyber security audit assists in the identification of vulnerabilities and potential risks within the organization’s IT systems, software, and hardware infrastructure. This enables organizations to proactively address vulnerabilities and mitigate potential risks.

Improvement in Security Posture

The IS Audit offers organizations suggestions to strengthen their digital security. These suggestions encompass best practices for minimizing risks and reinforcing the security framework of your organization.

Safeguards Customer Trust and Reputation

The IS RBI Audit aids in safeguarding your organization’s reputation and maintaining customer trust by minimizing the risk of data breaches and other cyber-attacks.

Book Your Free Cybersecurity Consultation Today!

Why Organizations Need an IS Audit?

RBI audit serves as a crucial step for organizations to ensure the integrity, confidentiality, and availability of their information systems. Here are some reasons why organizations need RBI compliance audit:

Protects Customer Data

IS Audit assists banks in pinpointing vulnerabilities within their IT systems and infrastructure that may expose customer data to cyber threats. By eliminating these vulnerabilities, organizations can safeguard their customers’ data.

Mitigates Cyber Risks

As cyber threats continue to evolve, organizations must remain vigilant to safeguard their digital assets. The RBI Audit assists organizations in identifying potential risks and vulnerabilities within their systems, enabling proactive measures to mitigate these risks. This proactive approach minimizes the impact of cyber attacks and safeguards the reputation of the company.

Enhances Cyber Security Posture

RBI Compliance Audit offers banks guidance to strengthen their cyber security position, including best practices for risk mitigation and enhancing the security framework. Implementing these recommendations enables banks to enhance their security posture and proactively address evolving cyber threats.

Enables Continuous Monitoring

The IS Audit is an ongoing process rather than a one-time event. It empowers banks to consistently monitor their security posture, identifying potential risks and vulnerabilities. This proactive approach enables banks to address these risks promptly and safeguard their digital assets.

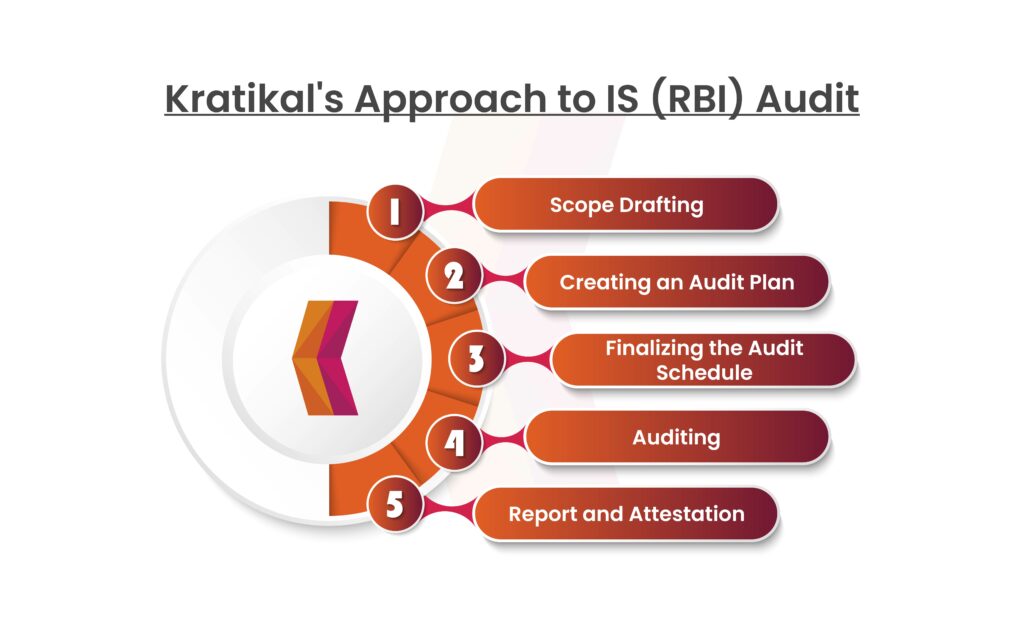

Kratikal’s Approach to IS Audit

Kratikal provides businesses with a wide range of cybersecurity solutions & services. Trusted by over 650 SMEs worldwide, Kratikal delivers robust cybersecurity solutions. Below is the approach of IS (RBI) audit that we follow:

Scope Drafting

The RBI Audit compiles information into a well-documented scope, objectives, and criteria, addressing stakeholder requirements and pain points. The scope encompasses the work systems, the number of departments, and the location of the organization.

Creating an Audit Plan

The board members must streamline an audit plan after defining the audit’s scope, aim, and criteria. The RBI Audit plan must entail the nature, timing, and scope of tests of controls and substantive procedures. Auditors and board members should also evaluate the network security measures.

Finalizing the Audit Schedule

A proper audit schedule must be published with the consent of all parties after outlining what must be audited and what is not required. It involves a timeline that suggests which departments should be audited within a certain time frame and is included in the audit schedule.

Auditing

The auditors will review the pre-implemented documentation and controls in the auditee’s organization after the audit schedule is made public. The audit’s goal is to find any inconsistencies or noteworthy observations in the NBFC’s workspace.

Report and Attestation

The auditing body will record its findings, suggestions for improvement, and minor and significant non-conformities against the departments that were the subject of the audit. A summary report will be created from all of these observations and the standard checklist that was used.ere the subject of the audit. A summary report will be created from all of these observations and the standard checklist that was used.

Why IS Audit Required?

Given the critical importance of digital data and the rising risks of cyber threats, organizations must take proactive measures to protect their digital assets. This is where RBI Information Security Audit Services play a vital role. Regular RBI Cyber Security Audits effectively identify vulnerabilities and potential risks in an organization’s IT systems, software, and hardware infrastructure. These audits assess compliance with RBI guidelines and other relevant regulations, offering recommendations to enhance digital security.

RBI Audit benefits organizations in several ways. First, they identify and mitigate potential risks and vulnerabilities, reducing the likelihood of data breaches and cyber-attacks, which in turn protects the organization’s reputation and customer trust. Second, these audits help organizations comply with regulatory requirements, avoiding potential legal and financial liabilities associated with data breaches or regulatory non-compliance. Regular RBI IS audits help organizations stay ahead of cyber threats and adopt best practices to enhance digital security.

Get in!

Join our weekly newsletter and stay updated

Conclusion

IS Audit is an essential process for banks and non-banking financial corporations to safeguard their digital assets and ensure robust cybersecurity. By identifying and addressing vulnerabilities, these audits help organizations mitigate potential risks, comply with regulatory requirements, and protect their reputation and customer trust. The RBI Audit continuous monitoring and best practices help organizations stay ahead of cyber threats and maintain robust security. Regular audits enhance security and proactively manage sensitive information in a digital world.

FAQs

- What is the duration of completing IS Audit?

The duration of an RBI Audit varies based on the audit scope, system complexity, and risk level. The security team at Kratikal collaborates with clients to set a timeline that meets their needs and ensures timely completion.

- What happens once the RBI Compliance Audit is completed?

After the completion of the audits, the auditing team provides a comprehensive report of the vulnerabilities and risks identified, along with the recommendations. The security team also provides the action plan and the steps to mitigate the risk. We also help the clients to implement the recommendations provided.

Leave a comment

Your email address will not be published. Required fields are marked *