Decentralized financial systems have grown in recent years. But when the phenomenon gained greater transactions, cybercriminals’ motivations managed to soar even higher. A difficult-to-alter digital ledger, the blockchain keeps track of transactions. But the crucial query is: Can blockchain be used in any way to manage the banking sector? Will there be any uses for the blockchain that can alter the way it operates? The answer is yes. Decentralized Finance is one of the best uses of Blockchain in Finance (DeFi). The basic idea of DeFi, as well as its advantages, how it functions, and potential applications, will be covered in this blog.

Table of Contents

What is Decentralized Finance (DeFi)?

A financial system called decentralized finance, or DeFi, is based on open blockchains. The building blocks of open finance are blockchain-based smart contracts, digital assets, dApps (decentralized applications), and protocols. Decentralized finance (DeFi) is a monetary system that is in-built on public blockchains. With the emergence of public blockchain networks like Ethereum, peer-to-peer asset transfers may now be programmatically carried out based on a set of criteria by “smart contracts,” which are just bits of code that are published and carried out on the blockchain.

Get in!

Join our weekly newsletter and stay updated

How does this work?

Financial services can be accessed through decentralized finance without the use of centralized intermediaries. Peer-to-peer interactions on the Ethereum blockchain are made possible through smart contracts. A financial system relies on two key elements to function properly

1. Infrastructure – Decentralized programming can be written on the Ethereum DeFi platform. You can use Ethereum to build smart contracts that define a set of requirements or guidelines that must be met before an agreement can be made. After being deployed, a smart contract cannot be changed.

2. Currency – A coin that can be used to communicate with the different protocols is required to build a safe, dependable decentralized finance system. The DAI stablecoin serves as DeFi’s primary form of payment.

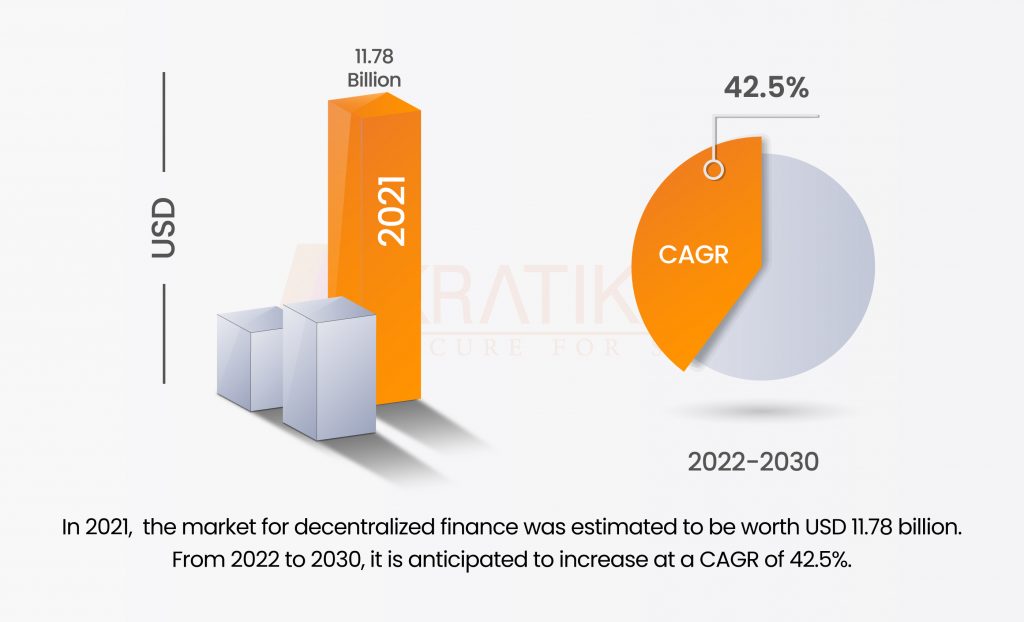

“In 2021, the market for decentralized finance was estimated to be worth USD 11.78 billion. From 2022 to 2030, it is anticipated to increase at a CAGR of 42.5%.”

Why is there a need for Decentralized Finance?

The underlying value and influence of decentralized technologies are extremely important, even though much of the attention and investment in them now is motivated by speculation. Below are the few important benefits of decentralized finance (DeFi) –

1. Elimination of Middle paths – Decentralized DeFi dApps do away with all intermediaries and human involvement, retaining the highest levels of security and integrity. Because business rules are automated within smart contracts that are implemented via the Blockchain platform, these smart contracts can operate autonomously without any need for human intervention.

2. Interact with each other – DeFi apps can work together safely because they were created to complement one another, demonstrating interoperability.

3. Completely Secure – DeFi apps offer total security during the transaction process because Blockchain is unchangeable and impervious to tampering.

4. Easily Accessible – One of DeFi’s key draws is its accessibility and openness, which enables anyone with an internet connection to take part in the growing ecosystem. Anyone wherever in the globe can access any DeFi app and its banking services. Decentralized Finance dApps are often developed on open, permissionless blockchains that anyone can use, and anyone may construct.

5. Transparency – Decentralized Finance offers total transparency of transaction operations to all users openly by appropriating Blockchain’s essential transparency attribute.

6. Permission-Less – The fact that decentralized finance (DeFi) is permissionless is one of its main advantages. This implies that no authorization from a centralized authority is required for everyone to utilize DeFi applications and services.

DeFi can be applied to the Real World

With the rising adoption of DeFi Platforms and processes, the potential to transform the lives of everyone is unbanked in the world. A few applications will be discussed below –

1. Cost Reduction – The outrageous costs on the remittance market need to be paid, where overseas employees move billions of dollars across borders to their families. Decentralized finance service trends have the potential to reduce these expenses by over 50%. This boosts worker productivity while also contributing to the expansion of economies.

2. Asset Financing – The DeFi ecosystem has introduced an extensive network of integrated DeFi protocols and financial instruments, ranging from lending and borrowing platforms to stablecoins and tokenized BTC. The DeFi team has unlocked a plethora of new opportunities for asset-decentralized finance and risk management by implementing immutable smart contracts on Ethereum.

3. Supply Chain Management – The term “DeFi” describes the transition away from conventional, centralized financial institutions and toward peer-to-peer financing made possible by decentralized technologies based on the Ethereum blockchain. This paradigm-shifting movement is already starting to converge with the supply chain management sector, opening up a whole new range of opportunities for cutting inefficiencies and creating new pathways for unreliable collaboration and decentralized finance.

Challenges Associated with DeFi

Risk is a component of any high-return financial instrument. Consequently, it is inevitable that DeFi would face several difficulties.

Tools for understanding and securely using cryptocurrency require specific knowledge and associated risk. It becomes the user’s obligation to maintain the security of their essential possessions and adhere to the multi-factor authentication procedure in the most private manner possible.

As a result of the excessive number of security-related occurrences, strict security and privacy algorithms have been introduced by numerous decentralized financial development companies. While the duty has been taken over by the solution’s developers, DeFi users should also keep themselves informed of any modifications to the terms of service for various wallets, exchanges, DeFi protocols, DeFi platforms, and other DeFi cryptocurrency initiatives.

Patching Up With This

To prevent fraud and scams, blockchain-based DeFi systems can be used to verify and validate transaction information. The experts at Kratikal, a CERT-IN empanelled organization will help to integrate VAPT services into your company’s security program if you are ready for this impending transformation and are willing to adapt the modifications into your software or ideas. Decentralized financial development services are available from Kratikal, including the development of smart contracts, currencies, applications, wallets, and more.

Along with our VAPT services, we provide security auditing for Compliance, like PCI-DSS, ISO/IEC 27001, GDPR, HIPAA, and others. Complying with these cybersecurity measures can reduce the threat of data breaches looming over Fintech, one of the industries that we serve.

We can assist you in achieving whatever goal you have for the financial future. We would be interested in hearing your insightful opinions on this.

Leave a comment

Your email address will not be published. Required fields are marked *