Do you recall the incidents involving Equifax, Target, and British Airways? Experiencing a data breach can significantly harm your business and reputation. According to research by the National Cyber Security Alliance, 60% of small businesses shut down within six months of a data breach. To mitigate the risk of such breaches, PCI compliance establishes stringent security protocols. Compliance is crucial as it is required when processing major credit card brands such as Mastercard, Visa, Discover, American Express, and JCB. Demonstrating compliance assures your customers that your company has implemented robust security measures to safeguard cardholder data. In this blog let’s understand how to get PCI Compliance certification.

Table of Contents

What is PCI Compliance Certification?

PCI DSS is a security standard for card transactions, which includes detailed policies and procedures to protect cardholder data and associated personal information

Established by the PCI SSC, PCI DSS (Payment Card Industry Data Security Standards) certification is a global security standard for organizations involved in the storage, processing, or transmission of cardholder data. This standard extends to practices of necessities such as installing a firewall, encrypted transmissions and running antivirus software. Remember that obtaining PCI certification requires access control access electronic cardholder data and monitor network resources to access. Obtaining PCI compliance certification is not an easy task. It symbolizes a badge of security that assures customers that your business can be trusted. Conversely, non-compliance can have significant financial and reputational costs.

Why is PCI Compliance Certification Required?

PCI compliance certifications are essential to protect sensitive cardholder and authentication information, whether stored, transmitted, or processed, regardless of your company’s size or global presence. Staying compliant requires annual verification, especially if you accept credit cards such as American Express, JCB International, Visa, and more. Responsibility for PCI DSS compliance extends to all entities handling credit card data, including collection, processing, and transmission. Service providers handling credit card payments must adhere to PCI DSS requirements.

Get in!

Join our weekly newsletter and stay updated

Steps to Get PCI Compliance Certification for Organizations

Understand PCI Complaince Requirements

To achieve PCI-DSS compliance, a business must fulfill around 12 general requirements. Below is the list of these requirements that organizations must adhere to:

- It is necessary to set up and retain the firewall configuration.

- Unique system passwords required

- Cardholder data that is stored should be secured

- Cardholder information should be encrypted when transmitted over public networks

- Antivirus software should be used and updated regularly.

- It is important to develop and sustain stable applications and systems.

- Access to cardholder data must be limited

- Each person with internet access must be assigned a unique ID

- Availability of cardholder information must be limited physically

- It is necessary to track and monitor access to cardholder data and network resources

- Security systems and processes must be checked regularly.

- A policy governing information security must be carried

Know about PCI Compliance Levels

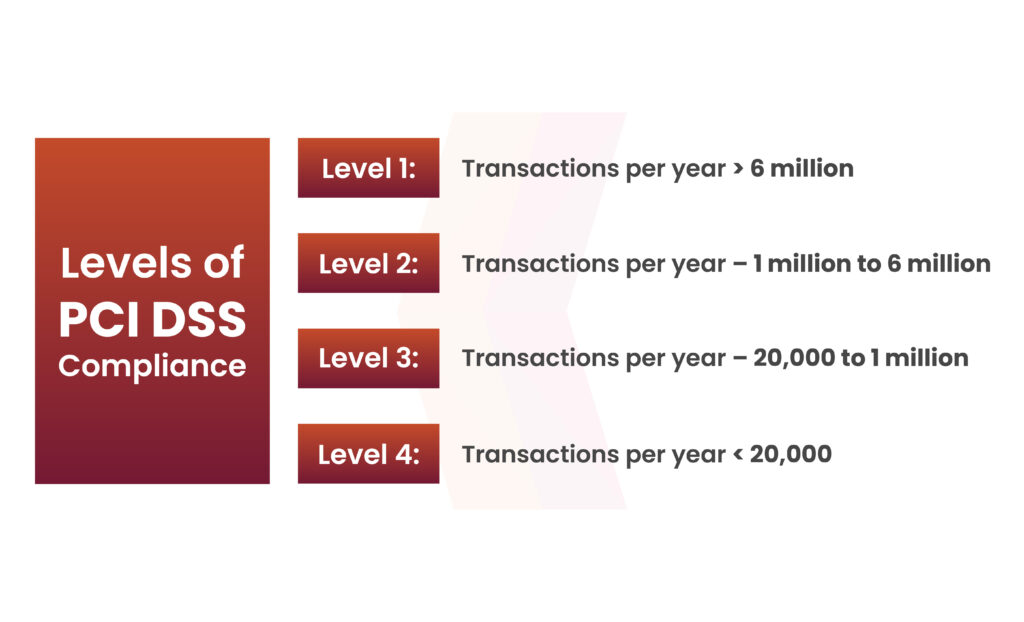

Now that you’ve gained sufficient familiarity with the twelve PCI DSS requirements, the next step towards PCI compliance certification involves identifying the relevant PCI compliance requirements applicable to your business. The PCI Council has categorized four PCI levels, each with distinct requirements. The level of PCI compliance primarily depends on the volume of online transactions processed annually within your cloud environment.

Below are the four PCI compliance levels crucial for advancing in the PCI DSS compliance certification process:

If your cloud-hosted company falls under Compliance Level 1, it’s imperative to engage a PCI-qualified security assessor (QSA) to conduct an audit confirming compliance with the PCI data security standard. Additionally, submitting an annual compliance report (ROC) is a mandatory aspect of your business processes. For cloud-hosted companies under Compliance Levels 2 & 3, completing a Self-Assessment Questionnaire (SAQ) is necessary to affirm the implementation of all security measures mandated by the PCI Data Security Standard. While not mandatory, it is advisable for cloud-hosted companies falling under Compliance Level 4 to also complete an SAQ as part of their progression towards PCI DSS certification.

Learn About PCI DSS Audit

PCI-DSS certification validates a company’s adherence to PCI standards throughout a defined period, with businesses engaging qualified auditors to ensure compliance, a process that can span months depending on company size and transaction volume; Level 1 businesses are obligated to conduct internal audits.

Conduct Security Assessment

In order to mitigate the risk of credit card data breaches, every cloud-hosted company must conduct a thorough risk assessment within their payment environment and analyze the intricate payment flow. This entails identifying potential threats and vulnerabilities to both credit card data and associated services processed by these companies.

Verify your Security Measures

After reviewing your security controls and protocols, coordinate with your IT and security teams to pinpoint areas where credit card data may be vulnerable within your company. The objective is to implement appropriate security configurations and procedures, such as Transport Layer Security (TLS), to protect data transmission. Alternatively, consider utilizing a compliance automation platform to assess gaps and devise a remediation strategy.

Prepare for PCI DSS Compliance Certification

PCI DSS certification requires assessment by external Qualified Security Assessors (QSAs), who are certified data security experts appointed by the PCI DSS Council. Upon selection, QSAs conduct comprehensive evaluations of various aspects of your organization, focusing on security controls aligned with the 12 PCI DSS requirements. Their role is to identify potential vulnerabilities in cardholder data environments, not to penalize your organization. They assess devices, public networks, and applications handling cardholder information, along with overall security policies and procedures, culminating in the submission of a detailed annual Report.

Benefits of PCI DSS Complaince Certification

PCI DSS offers fundamental security measures for safeguarding the customer data you hold. Additionally, achieving compliance brings direct and indirect benefits.

Prevention of Data Breaches

Data breaches are increasingly common occurrences for companies of all sizes nowadays. PCI-DSS aims to prevent these breaches by enforcing requirements to ensure comprehensive measures are in place to mitigate the risk of significant breaches.

Boosts Customer Confidence

PCI compliance is perceived by customers as a demonstration that your business adheres to best practices. Customer confidence significantly influences your brand reputation and revenue. Individuals who lack trust in your ability to safeguard their data are less inclined to make purchases. In fact, two-thirds of US adults would refrain from patronizing a business following a data breach.

Penalties can be Avoided

PCI DSS penalties are on a monthly basis until compliance is achieved, potentially accumulating rapidly or prompting rushed efforts to comply. The overall process is costly and has the potential to jeopardize your business’s financial viability.

Book Your Free Cybersecurity Consultation Today!

Conclusion

Obtaining PCI DSS compliance certification is not only essential for safeguarding sensitive cardholder data but also for maintaining customer trust and avoiding potentially crippling penalties. By adhering to PCI standards and implementing robust security measures, businesses can mitigate the risk of data breaches, boost customer confidence, and protect their financial viability. However, achieving compliance requires a thorough understanding of PCI requirements, diligent security assessments, and collaboration with qualified auditors.

Kratikal a CERT-In empanelled auditor provides businesses with a wide range of cybersecurity solutions & services. Trusted by over 450+ SMEs and Enterprises worldwide, Kratikal delivers robust cybersecurity solutions. We are one of the fastest-growing firms committed to safeguarding companies and organizations of different sectors, for instance, SaaS, Fintech, Healthtech, Govt., etc., against cyber risks.

FAQ

- Q1: What is PCI DSS Compliance?

Ans: PCI DSS aims to secure cardholder data by setting standards for its processing. Compliance is mandatory for organizations handling sensitive customer data, including those non-exclusively involved, depending on their interactions with other parties.

- Q2: What 4 things does PCI DSS cover?

Ans: PCI DSS covers 4 main areas: cardholder data protection, access control measures, secure network systems, and encrypted data transmission.

Leave a comment

Your email address will not be published. Required fields are marked *