Do you remember Equifax, Target, and British Airways? A breach in your data can have a serious negative effect on your business and image. 60% of small businesses close their doors within six months of a data breach, according to research from the well-known National Cyber Security Alliance. To reduce the possibility of these breaches, PCI DSS compliance sets strong security procedures. Compliance is essential as utilizing major credit card brands like Mastercard, Visa, Discover, American Express, and JCB requires it. Securing your customers with proof of compliance lets them know that your company has implemented robust security measures to effectively protect the cardholder data under your jurisdiction. In this blog, let us understand why PCI DSS compliance plays a key role in security of a business

Table of Contents

Brief About PCI DSS Compliance

The global security standard for organizations concerned with handling, transferring, or retaining cardholder data and sensitive authentication information. These duties include things like managing firewall settings, encrypting cardholder data, updating antivirus software often, and assigning unique identities to anyone with access to computers.

PCI DSS regulations are governed by the Payment Card Industry Security Standards Council, an impartial business enterprise mounted by way of card networks in 2006. Nonetheless, it’s the duty of the rate processors and card networks to put into effect those regulations.

Book Your Free Cybersecurity Consultation Today!

Why PCI DSS Compliance is Important?

During credit card transactions, this Compliance safeguards customers’ sensitive information. Even though it’s not always the right course of action, according to these rules is crucial for the continued protection of a commercial company’s name, consent, and protection. The importance of this compliance is explained by the following:

Protecting Customers Card Holder Data

The cardholder data that is given to your company for payment transactions or administrative duties is protected by this compliance. Businesses that handle data must implement the necessary security measures in response to the constantly changing cyber threat scenario. The widely used PCI DSS requirements defines trustworthy business practices and requirements that, when followed, ensure the security of customers’ cardholder information, boosting confidence in your capacity to manage such sensitive data.

Boosts Customer Confidence

Customers should feel reassured by firms that emphasize protecting their sensitive data when they follow this compliance. Showing that you are dedicated to protecting cardholder data builds trust and eases consumers’ experiences when they share such details with your company.

Establishes a Basis for Developing a Security Program

Agencies that align with Payment Card Industry Security Standards have the opportunity to evaluate their security based on a designated general. Following PCI DSS requirements helps to create a strong security posture for your business by emphasizing a robust protection architecture that includes antivirus, malware protection, firewalls that are configured correctly, encryption, and safety regulations. These security requirements highlight the need for a comprehensive IT security strategy that not only ensures PCI DSS compliance but also enhances general safety measures.

Mitigates the Chances of Data Breach

Meeting the compliance entails implementing an extensive range of security measures, including vulnerability management, encryption protocols, and consistent monitoring of systems for potential risks. These stipulations enable your business to actively strengthen security controls, thereby reducing the likelihood of a data breach.

Get in!

Join our weekly newsletter and stay updated

12 Requirements of PCI DSS Compliance

Ensuring robust security for cardholder data, PCI DSS requirements encompasses the following 12 requirements:

- Install and Maintain Network Security Controls

- Apply Secure Configurations to All System Components

- Protect Stored Account Data

- Secure Card Holder Data with Strong Cryptography During Transmission Over Open, Public Networks.

- Protect All Systems and Networks from Malicious Software.

- Develop and Maintain Secure Systems and Software.

- Restrict Access to System Components and Cardholder Data by Business Need to Know.

- Identify Users and Authenticate Access to System Components.

- Restrict Physical Access to Cardholder Data.

- Log and Monitor All Access to System Components and Cardholder Data

- Test the Security of Systems and Networks Regularly.

- Support Information Security with Organizational Policies and Programs.

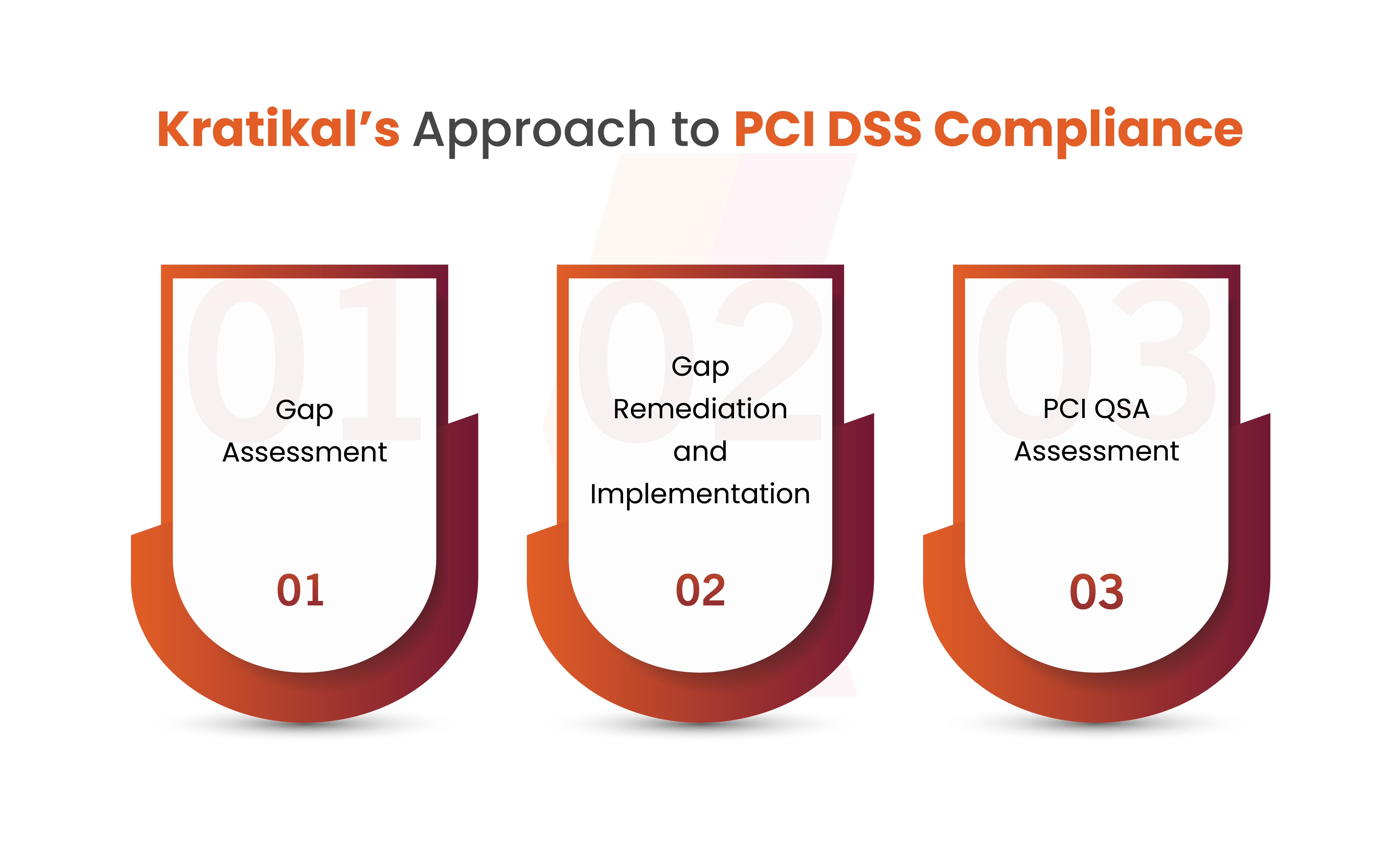

Kratikal’s Approach to PCI DSS Compliance

Gap Assessment

During this phase, Kratikal conducts a comprehensive gap and scope assessment, identifying processes handling cardholder information, initiating meetings with process owners, and reviewing organizational policies for compliance with all 12 PCI DSS requirements. Discussions with the IT department provide insights into network and application architecture, while process audits assess the adequacy of IT and security processes. The findings are consolidated into a gap report presented to stakeholders. To guide effective remediation, a prioritized roadmap is prepared based on risk exposure and PCI DSS implementation priority. This strategic approach ensures robust compliance and enhanced security measures.

Gap Remediation and Implementation

After completing the Gap Assessment, a specialized team of experts supports remediation and helps develop cybersecurity policies. Following basic training, they conduct risk assessments, document recommendations, and assign responsibilities. The support includes PCI scope reduction recommendations and assistance in finalizing controls. Non-technical implementation support involves reviewing and developing PCI DSS policies, processes, and procedures, conducting awareness sessions, and assisting in building stable processes for compliance, including risk assessment and mitigation planning.

PCI QSA Assessment

During a reliable PCI DSS audit and certification, a Qualified Security Assessor (QSA) thoroughly evaluates the information safety capabilities regarding every section of the PCI DSS Report on Compliance. This assessment is created fully according to the guidelines. After the audit, all records and the licensed RoC may be obtained by the buyer.

4 Levels of PCI DSS Compliance

This compliance outlines specific requirements to assist organizations in preventing payment data breaches.

These requirements aren’t universally applicable. Instead, there exist multiple PCI DSS compliance levels, determined by the volume of transactions an organization processes annually. The stringency of defenses and compliance auditing practices increases with the compliance level. While specifics may vary, the general structure follows these levels.

Ist Level: Merchants processing more than 6 million card transactions per year.

IInd Level: Sellers handling annual transactions ranging from 1 to 6M.

IIIrd Level: Businesses processing annual transactions beginning from 20,000 to 1 million.

IVth Level: Dealers dealing with less than 20,000 transactions annually.

Numerous reasons contribute to the low compliance level within an organization.

On Mar 31, 2022, the Payment Card Standards Council released an updated version. This includes adjustments to the compliance requirements. However, the previous model (3.2.1) remains in effect until 31st March 2024.

Conclusion

This guide highlights the importance, and the requirements of PCI DSS compliance for corporations, irrespective of size, in mitigating cyber threats. PCI DSS defines the 12 key requirements for the payment industry fostering trust and security. Kratikal’s approach involves a thorough gap assessment, gap remediation, and implementation along with PCI QSA assessment. The guide also outlines the four compliance levels based on transaction volumes, stressing a tailored approach. Overall, this guide is a valuable resource for organizations navigating payment card security standards, promoting security, data protection, and compliance.

Kratikal, CERT-In empanelled auditor, plays a pivotal role in enhancing security standards. With a history of successfully averting breaches, we utilize unmatched expertise to provide in-depth analysis and robust defense mechanisms against the ongoing threat of cyberattacks. Collaborating with Kratikal facilitates proactive identification and resolution of security vulnerabilities, thwarting the endeavors of malicious hackers attempting to exploit these weaknesses.

Leave a comment

Your email address will not be published. Required fields are marked *