The banking sector has always been one of the prime targets for hackers due to the highly sensitive nature of its operations. It holds not only vast amounts of money but also valuable customer data, making it a lucrative target. As users continue to embrace the digital economy, cybersecurity in banking has become a top priority for financial institutions worldwide. Traditional security measures are no longer sufficient to defend against today’s sophisticated cyberattacks. The effectiveness of these solutions directly impacts the protection of Personally Identifiable Information (PII), whether during accidental data leaks or targeted cyberattacks. By leveraging AI cybersecurity in banking sector, financial institutions can detect threats in real time, prevent data breaches, and ensure stronger protection of sensitive customer information.

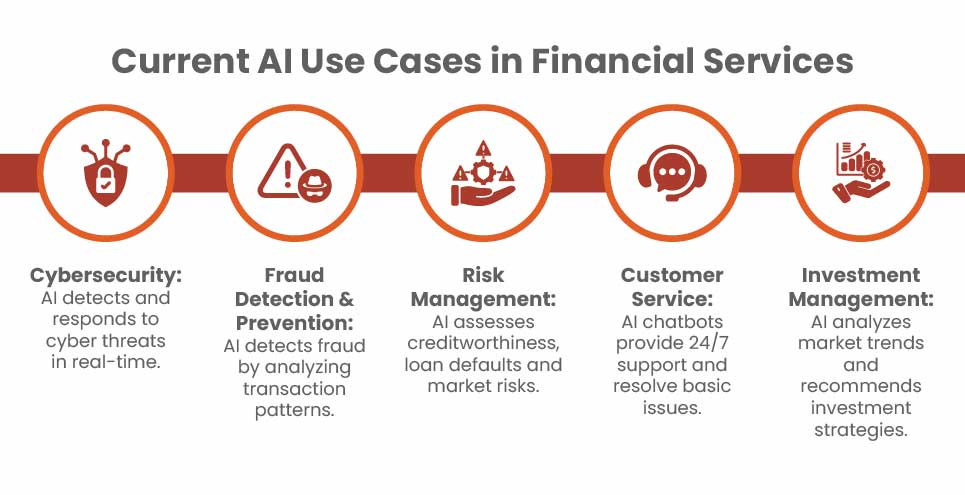

Studies suggest that AI-powered fraud detection has the potential to save banks nearly $10 billion every year. Organizations recognize that AI can revolutionize banking operations by processing massive datasets, spotting hidden patterns, and delivering precise predictions. In fact, a survey by The Economist Intelligence Unit found that 77% of bankers believe leveraging AI effectively will be the key factor that separates successful banks from those that fall behind. In this blog, we explore how AI cybersecurity in banking sector is making it stronger, smarter, and more proactive than ever.

Table of Contents

AI Cyber Security in Banking Sector

Financial fraud has has been rising due to cashless transactions and payment systems. The growing use of credit and debit cards, mobile wallets, and online banking platforms has created more opportunities for fraudsters to exploit vulnerabilities. Traditional security measures are no longer enough, as hackers now leverage advanced persistent threats (APTs), ransomware, and highly targeted phishing attacks to deceive users and compromise financial systems.

This is where AI plays a crucial role. AI-powered fraud detection platforms can analyze vast amounts of transactional data in real time, identify suspicious patterns, and flag potentially fraudulent activities before they cause harm. Machine learning algorithms continuously adapt to new fraud techniques, improving detection accuracy over time. AI also helps financial institutions automate fraud prevention, reduce false positives, and respond to threats quickly, protecting both the bank and its customers.

Why AI is Essentail for Preventing Financial Fraud?

There are several key reasons why banks are turning to AI-driven cybersecurity solutions for fraud prevention, including:

Efficiency and Accuracy:

AI-powered systems can analyze vast amounts of data faster and more accurately than traditional software. By doing so, they reduce errors in identifying normal versus fraudulent customer behavior, authenticate payments quickly, and provide analysts with actionable insights. Such capabilities are central to AI cybersecurity in banking sector, ensuring banks detect threats efficiently while maintaining operational accuracy.

Real-Time Detection

AI can instantly detect and flag anomalies in banking transactions, app usage, payment methods, and other financial activities. This enables faster fraud detection through AI cybersecurity in banking sector, helping banks block malicious activity and prevent potential fraud in real time.

Machine Learning Advantages

Unlike rules-based systems, which only identify pre-programmed anomalies, AI models leverage complex ML algorithms that continuously learn from historical data. These models adapt to evolving fraud patterns and build predictive systems that mitigate risks with minimal human intervention. This continuous learning strengthens AI cybersecurity in banking sector, providing banks with smarter, proactive defense mechanisms.

Enhanced Customer Experience

Beyond detecting anomalies efficiently, AI reduces false positives, a critical factor in protecting the customer experience. By safeguarding customers without compromising security, AI ensures that banking services remain seamless, secure, and reliable.

Role of AI in Preventing Financial Fraud

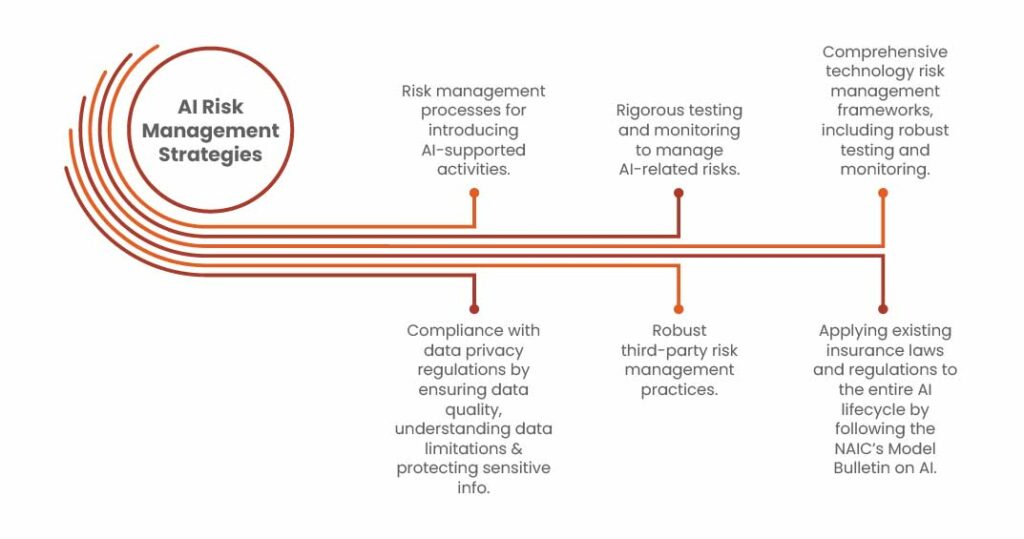

AI is playing a game-changing role in preventing financial fraud by enabling banks to analyze massive volumes of transactions in real time, identify anomalies, and stop malicious activity before it escalates. With AI cybersecurity in banking sector initiatives, financial institutions can go beyond reactive defense and proactively detect evolving fraud patterns using machine learning and predictive analytics. AI-powered VMDR platforms, like AutoSecT, take this a step further by continuously scanning networks, APIs, web, and mobile applications to uncover vulnerabilities that attackers could exploit. By combining automated threat detection, real-time risk validation, and prioritized remediation, such solutions empower banks to stay ahead of hackers, strengthen compliance, and protect customer trust.

AI Powered Cybersecurity for the Banking Sector with AutoSecT

The banking industry remains one of the most targeted sectors for cyberattacks, with threats ranging from ransomware and phishing to sophisticated, multi-stage intrusions. Traditional security measures, manual testing, fragmented tools, and slow vulnerability detection cycles — often leave banks exposed. AutoSecT, Kratikal’s AI-powered VMDR and pentesting platform, is designed to solve this challenge by unifying vulnerability scanning across networks, clouds, web apps, mobile apps, and APIs, all in a single dashboard.

Book Your Free Cybersecurity Consultation Today!

AI-Driven Capabilities for Proactive Threat Mitigation

AutoSecT uses advanced AI and automation to continuously detect, validate, and prioritize vulnerabilities as they emerge. Its AI engine simulates real-world exploits to confirm which vulnerabilities are truly critical, filtering out false positives and reducing alert fatigue. Through risk-based prioritization, AutoSecT ranks vulnerabilities by severity, business impact, and likelihood of exploitation — enabling banks to remediate high-risk threats first. This turns vulnerability management from a reactive process into a predictive, proactive security strategy that keeps pace with evolving threats.

Stregthening Banking Cybersecurity and Compliance

In the banking sector, compliance with frameworks like PCI-DSS, SOC 2, and ISO/IEC 27001 is crucial to maintain trust and avoid penalties. AutoSecT simplifies this process by providing compliance-ready reporting, continuous monitoring, and real-time risk intelligence. This helps banks demonstrate regulatory alignment while ensuring that sensitive financial data and PII remain secure, even against advanced cyberattacks.

Get in!

Join our weekly newsletter and stay updated

Conclusion

As cyber threats become more sophisticated, the banking sector cannot afford to rely on outdated security practices. The integration of AI cybersecurity in banking sector is no longer optional — it is a strategic necessity. AI enables financial institutions to move from reactive defenses to proactive, predictive security by detecting fraud, reducing false positives, and prioritizing the most critical vulnerabilities.

AI-powered VMDR platforms like AutoSecT elevate this approach further by unifying scanning, automating remediation, and providing compliance-ready insights, allowing banks to stay ahead of attackers while maintaining customer trust. By embracing AI-driven cybersecurity, banks not only protect sensitive data and assets but also strengthen resilience, improve operational efficiency, and ensure long-term regulatory compliance. The future of banking security lies in intelligent automation — and those who adopt it today will be best positioned to safeguard their customers and thrive in an increasingly digital economy.

FAQs

- How can artificial intelligence enhance cybersecurity in banks?

AI platforms streamline and automate the incident response process, minimizing the need for manual intervention and accelerating threat remediation. They analyze attack patterns and behaviors in real time, enabling security teams to respond faster and mitigate the impact of cyber incidents more effectively.

- What is the future scope of AI in cybersecurity?

AI is transforming cybersecurity by playing a vital role in advanced threat detection. AI-powered systems can identify threats in real time, allowing for rapid response and swift mitigation. Beyond detection, AI continuously adapts and evolves by learning from new data, strengthening its ability to recognize and counter emerging cyber risks with greater accuracy over time.

Leave a comment

Your email address will not be published. Required fields are marked *