With ongoing technological advancements, the frequency of online financial transactions is expected to rise, offering enhanced convenience for both customers and financial institutions. Additionally, data breaches and cyberattacks result in significant financial losses for institutions annually. Consequently, there is a growing interest among executives in bolstering cybersecurity for BFSI industry. Based on the findings of the S&P Global study regarding the distribution of cyber incidents reported across various industries in recent years, financial institutions have emerged as the sector most affected, accounting for over a quarter of such security incidents.

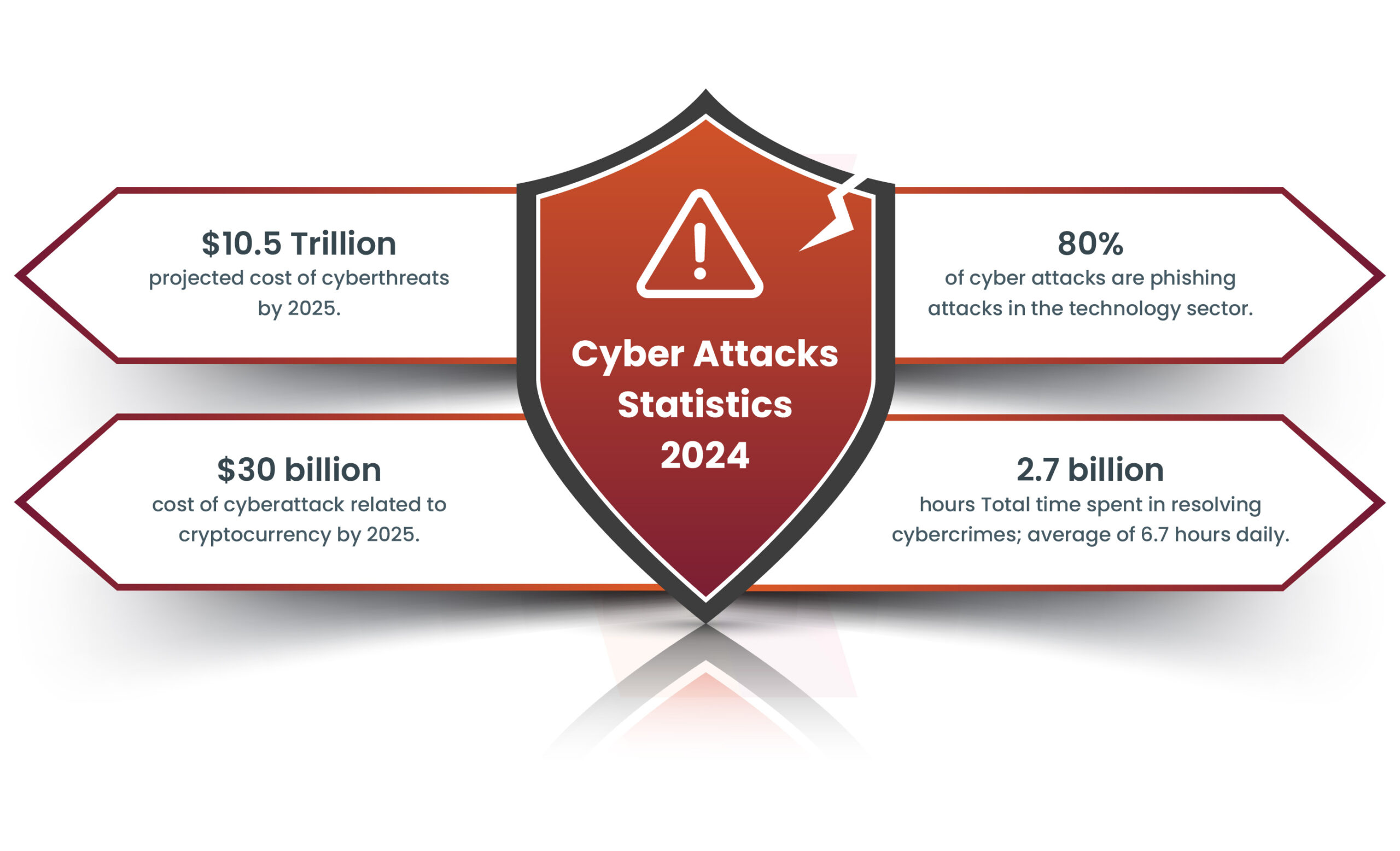

As the digital landscape evolves, so do the threats posed by cyber attackers. Here are some of the statistics that throws light on the impact of cyber threats:

- Over the next five years, cyber threat costs are projected to rise by 15%, reaching 10.5 trillion by 2025, according to Cybercrime Magazine.

- In 2023, the annual global cost of cybercrime was $8 trillion.

- Cybersecurity Ventures forecasts that cybercrime related to cryptocurrency will amount to $30 billion per year worldwide by 2025.

- According to Cybersecurity Ventures, ransomware is projected to incur approximately $265 billion (USD) in annual costs for its victims by the year 2031.

- In the technology sector, phishing attacks generally account for approximately 80% of reported cyber threats.

The increasing frequency of cyber threats emphasizes the vital role of cybersecurity in the banking sector today, especially for smaller financial institutions and credit unions that may lack the necessary resources to withstand the financial fallout of cyber-attacks. Moreover, these institutions face the risk of enduring significant damage to their reputation.

Financial entities encountered an increase in cyber threats, highlighting the importance of implementing robust cybersecurity measures. In this blog, we will discuss these threats, explore effective mitigation strategies, and highlight available resources for enhancing cybersecurity for BFSI industry.

Table of Contents

What is Cybersecurity in Banking?

Cybersecurity for BFSI industry involves the protection of hardware and software components against malicious attacks, encompassing computers, servers, mobile devices, electronic systems, networks, and data.

In the banking industry, cybersecurity refers to the implementation of technologies and strategies to prevent attacks on networks, software, and sensitive information. These threats may include the infiltration of viruses and malware, unauthorized access, hacking attempts, or data breaches. Also known as information technology security or electronic information security, cybersecurity in banking plays a crucial role in safeguarding users’ assets, both monetary and data-related, especially in an increasingly cashless society where online transactions are prevalent. Ensuring the security of these funds and the associated access information is paramount for banks.

Importance of Cybersecurity in Banking Sector

There are numerous compelling reasons for banks to prioritize cybersecurity. Given the sheer volume of transactions handled by banks on a daily basis, safeguarding data against cyber attacks is imperative. Here are some consequences of inadequate cybersecurity:

Customer Loss

In the event of a cyber attack, a bank risks losing a customer’s assets, potentially causing significant distress to the customer. While some funds may be recoverable, the loss of customer data typically poses greater challenges. Therefore, it is imperative for every bank to prioritize the protection of customer data.

Damage to Bank’s Reputation

Continual breaches in a bank’s customer data can erode trust, leading clients to seek alternative banking services. Robust cybersecurity in banking procedures are essential to prevent such occurrences and maintain customer confidence.

Digitization of Transaction

The shift towards digital platforms for banking transactions has increased banks’ vulnerability to hackers and malicious actors. Unauthorized access to these digital platforms poses significant risks and potential disaster for the bank.

Book Your Free Cybersecurity Consultation Today!

Common Cybersecurity Threats in Banking Sector

As cyberspace evolves, threats become more intricate and deceptive. Given the substantial financial assets and sensitive data involved, the banking sector must maintain heightened vigilance. It’s crucial to stay informed about some of the most formidable cybersecurity for BFSi industry threats. Here are just a few examples:

Ransomware

Ransomware is a type of cyberattack where hackers lock users out of their system and demand money to unlock it. If an organization doesn’t have backups, they may struggle to operate, and even if they pay the ransom, there’s no guarantee they’ll regain access or avoid future attacks.

Cloud Based Cyberattacks

As more data migrates to the cloud, cyber attackers are targeting cloud storage platforms more frequently. It’s crucial for banks to bolster the security of their cloud infrastructure to safeguard against breaches that could result in financial losses and data compromises.

Supply Chain Attacks

Hackers may compromise software suppliers to distribute seemingly authentic messages about updates or products to customers. However, these messages contain harmful code, compromising distribution systems and granting cyber attackers access to customer networks.

Types of Cybersecurity Solutions

As cyber threats evolve, maintaining robust cybersecurity measures becomes increasingly vital for banks and financial institutions. Here are some key pillars of cybersecurity for BFSI industry that can currently be implemented:

Cloud Security

With the increasing adoption of cloud computing by organizations, ensuring the security of cloud infrastructure is paramount. Some entities have opted to implement customized third-party security measures to bolster protection against cyberattacks, particularly those aimed at corporate financial systems. A robust cloud security strategy encompasses cyber security solutions, controls, and services designed to safeguard an organization’s cloud infrastructure from potential threats.

Mobile Security

Mobile devices like tablets frequently store data that cyber attackers can exploit to gain access to corporate information. Cyber attackers typically attempt to persuade users to install malicious mobile apps via phishing and instant messaging attacks. Mobile security safeguards the organization against such attacks by securing these devices and their operating systems. Given that employees regularly utilize mobile applications to access work-related information and resources, this is a matter that cannot be overlooked.

Application Security

Many financial institutions utilize secondary applications that are frequently linked to the internet, making them susceptible to attacks like broken authentication, misconfiguration, and cross-site scripting. Application security is essential for preventing cyber attacks and preventing malicious interactions with applications and APIs.

Endpoint Protection

Endpoint protection entails securing systems from the user end, focusing on employees’ devices that access the organization’s network, including laptops and desktops.

If you want to know more about the endpoint control you can watch our webinar on “Vital Role of Endpoint Control and Compliance”.

Network Protection

Networks are commonly targeted and considered crucial, prompting corporations to prioritize robust network protection with effective enforcement of secure web policies. A comprehensive network protection approach encompasses network analysis, proactive threat detection, and the implementation of automated security and response orchestration (SOAR).

Get in!

Join our weekly newsletter and stay updated

Why BFSI Sector Needs Cybersecurity?

Cybersecurity in banking sector plays a vital role in the financial sector due to the sensitive and vast volumes of data stored by banks and financial institutions. In the event of a breach, attackers could exploit this data, auctioning it off and potentially causing significant financial losses to customers.

Moreover, the substantial cost of data breaches underscores the critical importance of cybersecurity for BFSI industry. Prolonged periods to identify and contain breaches, averaging 233 days, provide attackers ample time to carry out malicious activities. Additionally, the extensive access granted to financial service employees, who typically have access to millions of files, highlights the potential vulnerability of the sector. With cybercriminals targeting employees, the cybersecurity for BFSI industry faces considerable exposure to sensitive data, making robust cybersecurity measures imperative.

Conclusion

The importance of cybersecurity for the BFSI sector cannot be overstated, given the critical role financial institutions play in managing vast volumes of sensitive data and transactions. By implementing comprehensive cybersecurity measures, including cloud security, mobile security, application security, endpoint protection, and network protection, banks and financial institutions can effectively mitigate cyber risks and safeguard their operations. With proactive approaches to cybersecurity, the BFSI industry can trust, protect customer assets, and uphold its reputation in an increasingly digital world.

Kratikal a CERT-In empanelled auditor provides businesses with a wide range of cybersecurity solutions & services. Trusted by over 450+ SMEs and Enterprises worldwide, Kratikal delivers robust cybersecurity solutions. We are one of the fastest-growing firms committed to safeguarding companies and organizations of different sectors, for instance, SaaS, Fintech, Healthtech, Govt., etc., against cyber risks.

FAQs

- Q1: What is the importance of cybersecurity in BFSI?

Ans: Ensuring the safety and security of customer data through robust cybersecurity measures is imperative. It is crucial for maintaining the integrity of the banking sector and ensuring the sustained viability of business operations.

- Q2: What is cyber security in the finance industry?

Ans: Cybersecurity plays a pivotal role in averting financial losses for the banking sector. Through the implementation of network security, intrusion detection systems, malware protection, and other cybersecurity protocols, financial institutions can effectively prevent cyber attacks and minimize their adverse effects.

Leave a comment

Your email address will not be published. Required fields are marked *